Investment goals and risk posture, as well as financial position change, over time. These changes must be taken into consideration in building an investment portfolio.

Life cycle investing theory looks at these life stages and proposes model portfolio formats designed to achieve those goals within set risk parameters.

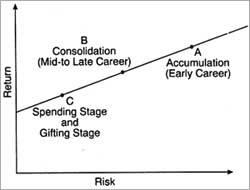

According to life cycle investing theory, individuals travel through different life stages with different investment goals and risk tolerances associated with them. For the average investor, without taking into account the life cycle approach, the risk/return relationship would be depicted as shown in accompanying Figure 1.

Each individual would have to determine for him or herself how much risk they want to assume to achieve greater returns, as evidenced by a move to the right on the risk/return line.

Figure 1

Risk

Typically, younger investors would take a higher risk posture to garner higher returns and build up their wealth (Point A). If losses occur, they have the time to recoup.

On the other hand, older investors would stay on the lower end of the risk/return line, preferring to protect existing wealth (Point B). Their investment posture would obviously be tempered from losses incurred in earlier years.

Franco Modigliani first put forward the 'Life Cycle Hypothesis of Income, Consumption and Saving.' His treatise contended that people move through a progression of dissaving (spending more than they earn in their younger years) to a period of net saving (as wealth increases) to another period of dissaving as they retire and live off previously accumulated financial assets.

Inherent in the life cycle theory is that certain types of investments and risk postures are more favourable for certain stages of investors' lives. The theory also recognises the importance of early planning and anticipation of future financial commitments and cash outflows (such as college expenses).

Finally, it stresses the importance of remaining flexible enough to make the appropriate changes in investments as the individual progresses from one life stage to another.

Four phases comprise the life cycle. Each phase and its characteristics are noted in the accompanying Table 1. You can follow the movement in the life cycle's phases in Figure 2.

Table 1

Life Cycle Phases and Characteristics

|

Phase |

Characteristics |

|

Accumulation |

Early career, small net worth, large liabilities such as house mortgage and credit purchases, illiquid assets. Priorities include |

|

Consolidation |

Mid-to-late career. Best income earning years coupled with declining expenses as children leave home and house expenses taper off. Peak wealth accumulation years. Institution of more risk control to protect built up capital. (Point B) |

|

Spending |

Retirement years. Financially independent status. Accumulated assets cover living expenses. Low risk posture to converse and protect assets for income generation. (Point C) |

|

Gifting |

Realization that accumulated assets exceed anticipated living expenses. Redirection of assets to provide for heirs or other causes. Still low-risk posture to ensure passing along assets with the exception that some people at this phase take on pet projects without regard to the amount of risk involved. |

Figure 2

Risk/Return Relationship at Life Cycle Phases

According to Donald R. Nichols in his book, Life Cycle Investing, investors must take into account five key elements in constructing a life cycle portfolio:

- Stability of principal;

- Current income;

- Capital growth;

- Aggressive income, and

- Growth and lump sum investments.

Investors achieve principal stability with the help of investments that provide optimum protection against market loss and value fluctuations. While such an investment will earn some return, the paramount consideration is to guard against loss of the principal amount.

Current income generating investments, such as dividend from common and preferred stocks, bonds, certificates of deposit, and savings accounts take on more importance as investors progress through the life cycle phases.

Capital growth investments seek long-term capital appreciation to build the desired level of wealth with which to live through the retirement years, an important investment strategy in the early to mid-years of the life cycle.

Ideal growth oriented investments include common stocks, mutual funds and bonds as well as hard assets such as real estate and precious metals.

Company-sponsored pensions, profit-sharing, and savings plans also build wealth rapidly, sometimes with the company making a substantial proportion of the contributions. Individual contributions can also be made pre-tax, adding to the growth capabilities of the investment.

Aggressive income and growth investments combine higher potential returns with a higher degree of risk and are appropriate for those in the accumulation phase of the life cycle. Again, stocks, bonds and mutual funds join forces with more speculative investment alternatives such as precious metals, currencies, commodity futures, and options.

Lump sum investment provides continual growth and wealth accumulation within a specific time frame. Zero coupon investments and certificates of deposits represent popular lump sum investments. These can be utilized during any phase of one's life cycle.

[Excerpt from:

100 World Famous Stock Market Techniques

By Richard J. Maturi

Publisher: Vision Books

Price: 190

Richard Maturi is a nationally syndicated investment columnist in the United States and the author of several books.

[C] All rights reserved.