Here's where we step in with our experts, Relax With Tax.

Got a question for Relax With Tax? Please write to us!

I filed my previous returns in Mumbai but now reside in Gurgaon. Also, my name has been changed after marriage.

I filed my previous returns in Mumbai but now reside in Gurgaon. Also, my name has been changed after marriage.

What must I do now about my filing of returns?

- A Mishra

Send a letter to the relevant assessing officer in Mumbai to transfer your file to the relevant officer at Gurgaon.

Then make a rectification application of your Permanent Account Number with the correct address and changed name to UTISL.

I sold few of my ESOPs within a year of buying it.

Does the profit fall under taxable income? If yes, what is the percentage for tax and how it is calculated? Will Form 16 reflect this amount?

- Deepak K Ratnala

Since you sold your shares within a year, it is a short-term asset. Accordingly, if such an equity share transaction is chargeable with the Securities Transaction Tax, then the rate of tax would be 10% (plus surcharge plus education cess).

As these sale transactions are outside the employer's purview, these may not be included in the Form 16 issued by the employer.

I work in Bangalore. If I am deputed to either of the company branches in Chennai or Mumbai for a few months, I will be receiving a per diem allowance.

Is this per diem allowance taxable in the hands of the employee or recipient?

If so, at what rate of tax? How much, if any, is totally exempt from tax?

If it is not taxable, can I please know under which section and sub-section it is exempted from tax?

- Samir Zaveri

Per Diem allowance is to meet expenses when on travel to locations outside the regular place of residence. Hence such allowance is exempted to the extent of actual expenses incurred by the employee.

Any portion of unspent allowance is taxable as salary and would be taxed at the regular rate of tax applicable to the total income.

Got a question for Relax With Tax? Please write to us!

Note: Questions may be edited for brevity. Due to the tremendous response, all queries will not be answered.

Disclaimer: While efforts have been made to ensure the accuracy of the information provided in the content, rediff.com or the author shall not be held responsible for any loss caused to any person whatsoever who accesses or uses or is supplied with the content (consisting of articles and information).

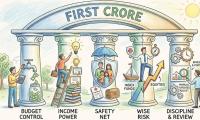

Illustration: Dominic Xavier