n December 6, the chairman of the State Bank of India, A K Purwar, said he expected interest rates to rise. And potential borrowers groaned.

n December 6, the chairman of the State Bank of India, A K Purwar, said he expected interest rates to rise. And potential borrowers groaned.

His words in technical jargon: There is still some upward pressure on the lending rates.

His words in simple English: There is a possibility that interest rates on loans could rise even more.

He cited inflation as one of the reasons.

In case you are thinking of closing this window because a lesson in economics does not interest you, hang on. It's time you found out how inflation affects interest rates and how interest rates affect you when you borrow or invest.

What's inflation?

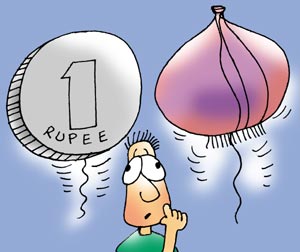

At its most basic level, inflation is simply a rise in prices over time, as the cost of goods and services increase. As a result, the value of a rupee (which is already pathetic) reduces. You won't be able to purchase as much with a rupee, or Rs 100 for that matter, as you could some years ago.

What this means: As inflation increases, the value of the rupee decreases.

Got that. Now, what does interest rate mean?

Let's say you want to buy a house. The price is Rs 12 lakh.

You don't have that much money, so you go to a bank and they agree to loan you Rs 10 lakh. You agree to repay this money over a period of time.

But the bank will not give you Rs 10 lakh free of cost. They will charge you some amount of money for the loan. This is known as interest. And you will pay it, along with the loan amount, over a fixed period of time.

To make this simpler, let's get into specifics.

For your loan of Rs 10 lakhs, which you have agreed to repay over five years, the bank will charge you an interest rate of nine percent per annum. This nine percent is the price you pay for borrowing money. This means you will repay the entire Rs 10 lakh as well as interest at nine percent in these five years.

What this means: Just as you pay money to buy your home, interest is the money you pay to acquire the finance you need.

How inflation affects the interest rate

The interest rate is the cost of borrowing money.

Let's say, the bank gives you the home loan at nine percent interest. This is called nominal interest.

Let's also say that inflation is currently at seven percent. This means the real interest the bank earns is just (nine minus seven percent) two percent (for the week ending on November 20, 2004, inflation was 7.34 percent).

As inflation increases, the bank will also increase its nominal interest rate so that the 'real' interest rate it earns stays somewhat constant.

What this means: As inflation rises, interest rates are likely to rise as well.

From your point of view

Let's say you lend a friend some money today and he agrees to pay you back in eight years.

By that time, the price for everything would have gone up, right?

So the Rs 15,000 you gave him will be able to buy you more things today than it would in 2012, when he returns your money. To make up for that loss in the value of the money, you charge him interest.

What this means: Interest protects you against future rises in inflation.

How interest rates affect the investorCheer up! If interest rates on loans rise, they will also rise on your fixed-return investments like fixed deposits and bonds. So all is not lost.

When interest rates are high, fixed return investments are a good bet. That is the time you should lock into bonds and fixed deposits. These investments are safer than shares because they guarantee a return.

The interest rate is also seen as an indicator for the economy at large. High interest rates mean it is now more expensive for businesses (companies) to borrow money to expand. This, in turn, will affect their profits.

When interest rates are low, shares are a good investment because the price banks, institutions and companies are now willing to pay to borrow your money has gone down.

What this means: Check the interest rates you are getting on your fixed return investments. If it is lower than the present rate of interest, break that fixed deposit and promptly reinvest it.

How interest rates affect the borrower

If you are taking a loan when interest rates are low, the best thing to do is to opt for a fixed loan. As a result, even when rates begin to rise, you are safely 'locked' into a lower rate.

If interest rates are high when you are taking a loan, it would be better to opt for a floating rate loan option. As interest rates climb down from their peak levels, you will be able to benefit from a fall in the interest rate. You have my sympathies if you have locked in at a high rate. Because, when the interest rates do fall, you will be stuck paying a high interest on your loan.

On a closing note, do remember there are a host of factors in the economy -- the economic growth rate and unemployment, to mention a couple -- which influence interest rates. Inflation is just one of them. But, as the SBI chairman observed, it is currently the most impactful.

Read: What to do with your money

Tomorrow: Home loan: Fixed rate, Floating rate or both?

Illustration: Uttam Ghosh